Bridging Loans

Bridging Loan Solutions from Station Hill Capital

A bridging loan is similar to a mortgage and is used by individuals and businesses to purchase or raise capital secured against either a residential and/or commercial property or a land asset. Unlike traditional commercial mortgages, execution and drawdown happens much faster.

How does bridging finance work?

- Bridging lenders focus on property suitability as security

- Bridging loans often include an interest reserve facility which allows lenders to collect interest without monthly payments.

- This means the borrower doesn’t have a monthly repayment to service, although serviced bridging loans are available.

- Bridging lenders prioritise the exit strategy when assessing a proposition. The key question is: “How will the borrower repay the loan?“.

- Common bridging loan exits:

- Re-mortgage with a conventional lender

- Sale of the property used as security

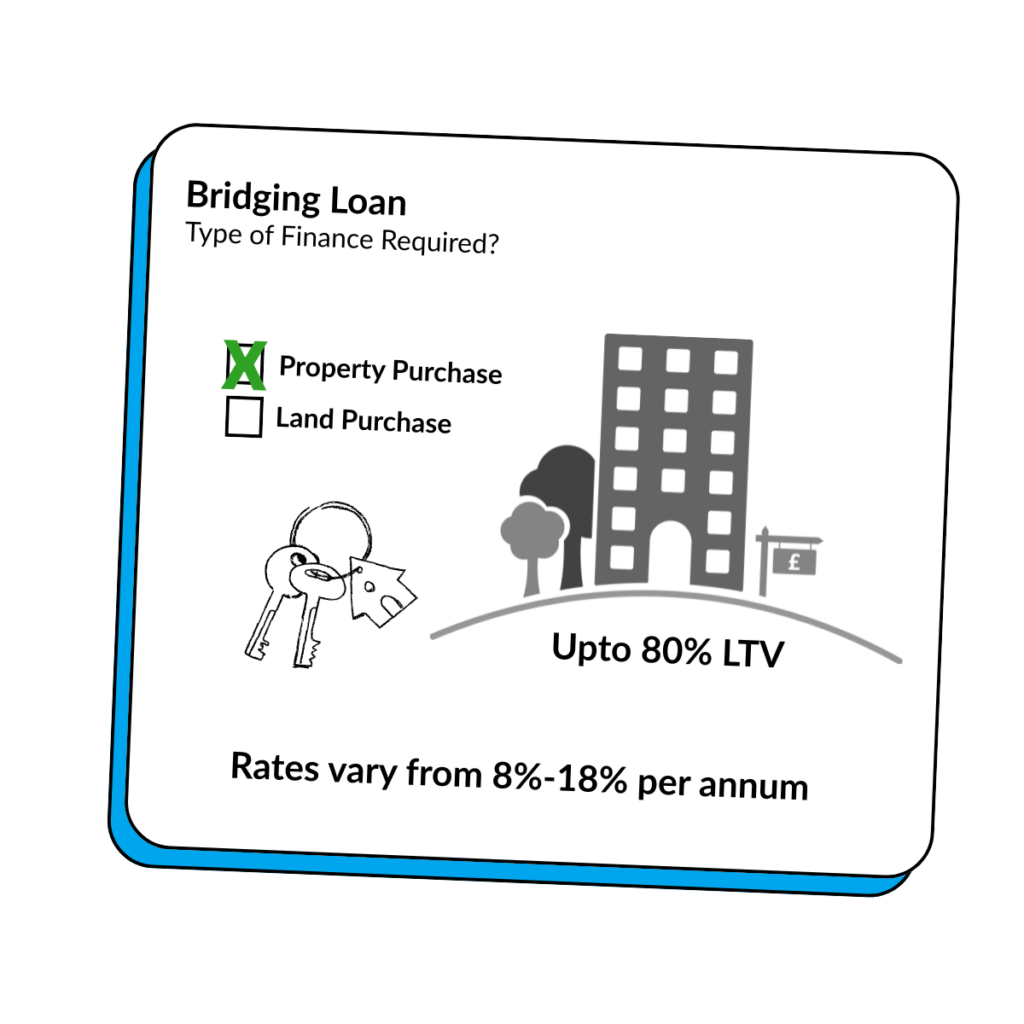

- Up to 80% LTV is available, depending on the property type.

How much does it cost?

- The costs vary depending on lender, loan amount, security type, term of the facility and the credentials of the borrower

- Rates vary from 8%-18% per annum.

- Pricing is linked to a lender’s perceived risk of each deal, with bespoke pricing applying to each application.

- Pricing isn’t the only important factor when it comes to Bridging Loans. Insight to the lender is vital, which is where a good broker will add value to your application.

Do I need a Broker?

The short answer is yes. There are a large number of bridging lenders across the UK, Ireland, USA, Canada, Australia and South Africa. Due to the complexity of the process, most of them are set up to work alongside finance brokers.

Is my business eligable for bridging finance?

- Any company may obtain a bridging loan if they are the owners or the intended purchasers of a property that is considered suitable security by a lender.

- Any ultimate beneficial owner of a borrowing company must be at least 18 years of age.

How long can I use a bridging loan for?

- Bridging loans can be short-term, spanning from one month to several years

- Quick repayment via a robust exit strategy is encouraged to save on interest and fees

- Many bridging lenders prefer fast repayment and don’t charge redemption fees

- Some offer ‘open-ended bridging loans‘ with no fixed term for flexible repayment

What is I have bad credit?

- Bridging loans focus on property, making them accessible for those with limited borrowing options due to poor credit history.

- Personal credit scores matter less; lender prioritises the exit strategy

- If a re-mortgage is the exit, proof of viable re-mortgage is required

- Lenders vary, some prefer prime borrowers, others work with those with credit issues

- Borrowers track record affects interest rates and fees

- Most bridging lenders focus primarily on property value and a clean legal title for their security

Typical Use Case

A property development company that has just agreed to purchase a prime site at auction. The terms of the auction mean the balance must be paid within 28 days, but their long-term commercial mortgage will take at least three months to arrange.

To secure the property without losing the deal, the developer uses a bridging loan. The lender approves finance quickly, secured against the property being purchased, with an interest reserve so no monthly payments are required during the term.

With the bridging loan in place, the developer completes the purchase on time. Over the following months, they finalise their commercial mortgage. Once the long-term finance is drawn down, the bridging loan is repaid in full.

Let’s Make Bridging Finance Work For You

Unlock fast, flexible funding tailored to your needs. Whether you’re securing a property purchase, raising short-term capital, or refinancing, our team will guide you through the options and connect you with the right lender.